In today’s world of finance, the less personal information you share online, the better. Hence, a virtual card is a secure, safe and convenient way for you to pay online. In this blog post, we will explore what virtual cards are and how to use your virtual card wisely without compromising convenience.

What Is A Virtual Card?

A virtual card is a digital alternative to a physical debit card. Surprisingly, Allied market research, says global virtual card market is valued at $281.22 billion in 2021 and expected to grow up to $1.893.08 trillion by 2031. Armed with a unique 16-digit card number, CVV, and expiry date, a virtual card is designed for online transactions. What’s more, it provides an added layer of security against fraud.

How To Use Your Virtual Card Wisely

1. Shop Online with Confidence

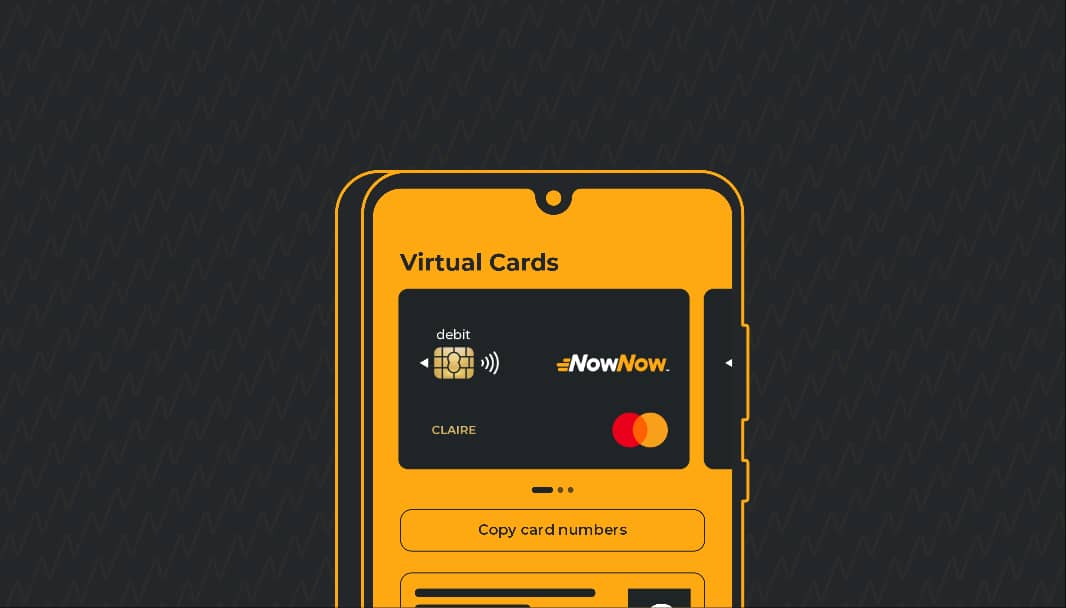

Using virtual cards, like the NowNow virtual card, is perfect for secure online transactions, from e-commerce purchases to online courses to booking rides. Safeguard your privacy and security while completing transactions effortlessly.

2. Set Smart Spending Limits

Take control of your budget by using your virtual card to set custom daily, weekly, or monthly spending limits. Avoid overspending and stay within your financial boundaries.

3. Effortless Expense Tracking

Virtual cards are a lifesaver, as they can bе usеd to monitor real-time expenses for real-time expense monitoring. Track your spending habits conveniently through mobile apps, gaining a clear understanding of your financial habits.

4. Make In-Store Purchases

Believe it or not, you can make in-store payments with your virtual card. Look for stores supporting contactless payments, allowing you to tap with your mobile for seamless transactions.

5. Subscription Payments Simplified

Easily pay for subscriptions like gym memberships or streaming services through your virtual card. Set up the card for specific recurring payments and, if needed, delete it when you decide to end the subscription.

6. Enhanced Account Security

Enjoy an extra layer of security with virtual cards. Block or terminate your card instantly through your mobile app if you detect any fraudulent activity, ensuring your financial safety.

7. Digital Wallet Integration

Seamlessly integrate your virtual card with popular digital wallets like Google Pay, Apple Pay, Samsung Pay, or the NowNow mobile wallet. Enjoy contactless payments at physical stores that embrace these digital payment methods.

Experience the benefits of virtual cards with NowNow cards

Get a free NowNow virtual card and embrace the new new way to bank. View your NowNow virtual card details and get complete control to pay anywhere, anytime, set spending limits, enjoy 3D security, and more. Step into the world of NowNow cards, where your financial freedom awaits.

Bottom Line

In conclusion, the versatility of virtual cards extends from online shopping to secure subscriptions and contactless payments. Embrace the future of payments where security and convenience coalesce, transforming transactions into a seamless part of your digital journey.